WTF happened with FTX

It all started with a Coindesk article that featured a breakdown of a leaked Alameda balance sheet. Link

The financials make concrete what industry watchers already suspect: Alameda is big. As of June 30, the company’s assets amounted to $14.6 billion. Its single biggest asset: $3.66 billion of “unlocked FTT.” The third-largest entry on the assets side of the accounting ledger? A $2.16 billion pile of “FTT collateral.”

There are more FTX tokens among its $8 billion of liabilities: $292 million of “locked FTT.” (The liabilities are dominated by $7.4 billion of loans.)

“It’s fascinating to see that the majority of the net equity in the Alameda business is actually FTX’s own centrally controlled and printed-out-of-thin-air token,” said Cory Klippsten, CEO of investment platform Swan Bitcoin, who is known for his critical views of altcoins, which refer to cryptocurrencies other than bitcoin (BTC).

Alameda CEO Caroline Ellison declined to comment. FTX didn’t respond to a request for comment.

Other significant assets on the balance sheet include $3.37 billion of “crypto held” and large amounts of the Solana blockchain’s native token: $292 million of “unlocked SOL,” $863 million of “locked SOL” and $41 million of “SOL collateral.” Bankman-Fried was an early investor in Solana. Other tokens mentioned by name are SRM (the token from the Serum decentralized exchange Bankman-Fried co-founded), MAPS, OXY, and FIDA. There is also $134 million of cash and equivalents and a $2 billion “investment in equity securities.”

The majority of the “assets” on their balance sheet are illiquid FTT tokens and a bunch of shitcoins. Let’s break down why FTT is so important to the FTX / Alameda empire.

Per FTT’s stated tokenomics, FTX has pledged to use one-third of all exchange fees to buy back FTT. SBF owns the majority of Alameda’s equity, while he continuously dilutes his FTX ownership to ship in capital from VC muppets. These VC muppets probably didn’t realize — or maybe they did, which is even worse for their investors — that a good chunk of FTX’s revenue was siphoned from FTX to Alameda through Alameda’s large FTT stake. Presumably, Alameda received a large allocation of FTT for providing essential market-making services to FTX, and its participation in the FTT initial coin offering.

Ok, so that’s not ideal for FTX investors, but it isn’t what struck the death blow to FTX’s solvency. The real issue started when people started to raise questions in the wake of the Coindesk article — whether FTX loaned Alameda money (most likely USD or fiat stablecoins) and used Alameda’s FTT stake as collateral. If FTX did loan the funds, that isn’t an inherently fatal issue either — FTX was free to loan out its retained earnings to whomever it pleased. But the most pressing related concern was whether FTX rehypothecated customer deposits to Alameda and took FTT as collateral. Whether the fall in the value of FTT or some of the shitcoins on Alameda’s balance sheet would thus render Alameda insolvent. Butt finally, if Alameda became insolvent, would FTX lend money from client funds to prop it up? Again, these were the questions that people began asking after this article came out (As seen on crypto Twitter).

Lucas Nuzzi has an interesting theory on the connection between FTX, Alameda, and FTT. In short, he argues that Alameda blew up alongside Three Arrows Capital and others, but FTX lent Alameda money to survive in exchange for FTT tokens due to Alameda via its participation in the FTT ICO.

Then, CZ struck.

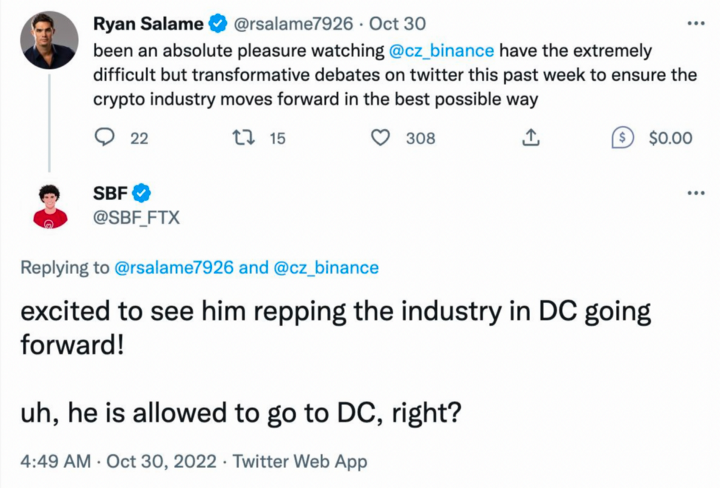

CZ read the same article as everyone else and decided to dump Binance’s sizeable FTT stake in the market (posted on my story). There was also apparently some beef between the two crypto Barons.

That’s not very nice, Sam (CZ believes that he will be arrested as soon as he steps foot on U.S soil by regulators hence why he never goes back and always appears via zoom).

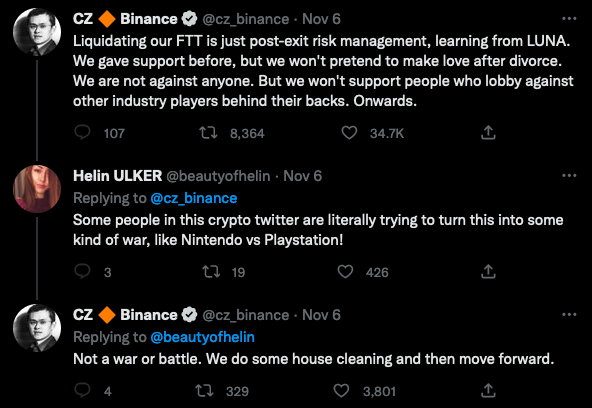

CZ doesn’t make love after divorce … seems reasonable. I guess CZ and SBF had a messy breakup.

Once CZ started airing his concerns, alarm bells started ringing in the heads of FTX depositors.

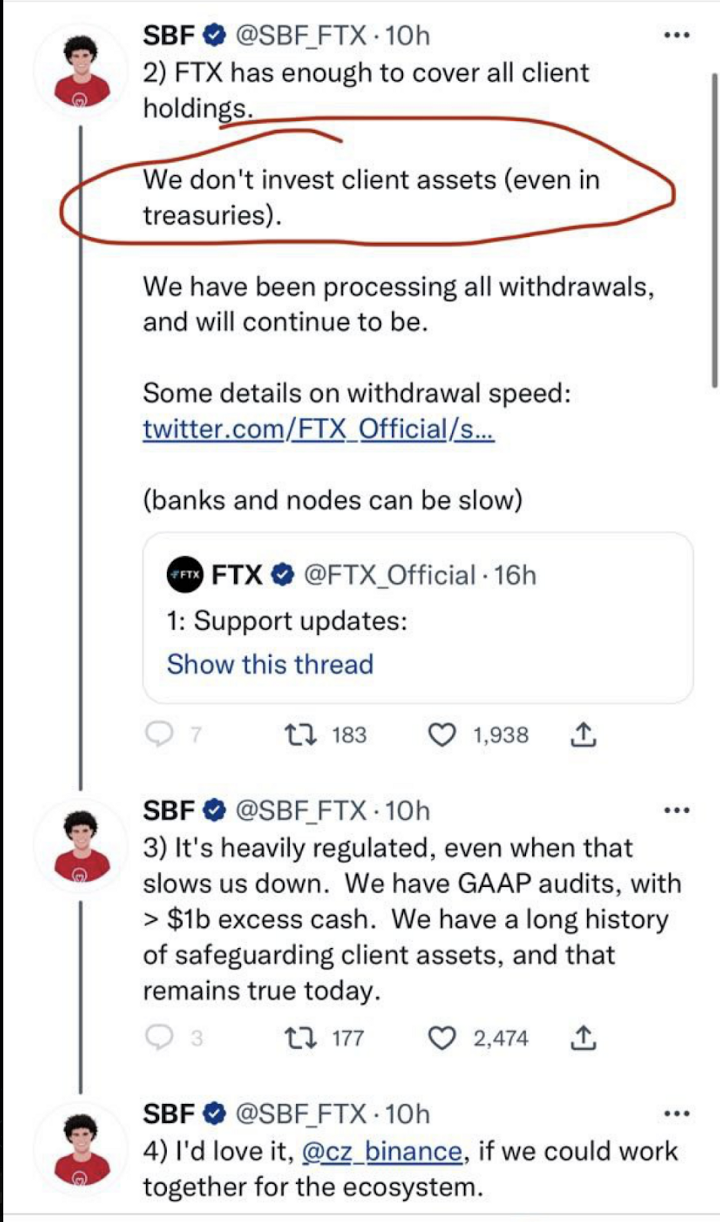

In crypto, when you have even an ich that an exchange might be insolvent, you pull your funds immediately and ask questions later. Logic suggests that even if Alameda went bust, FTX should suffer no issues processing all withdrawals. They are two separate companies, and according to SBF’s claims, FTX’s customer deposits weren’t reinvested — not even in super duper safe US Treasuries.

At this point, there was no reason to believe SBF was lying. But even still you ain’t gonna wait around to find out with your money on the line. Therefore capital started sprinting for the exits.

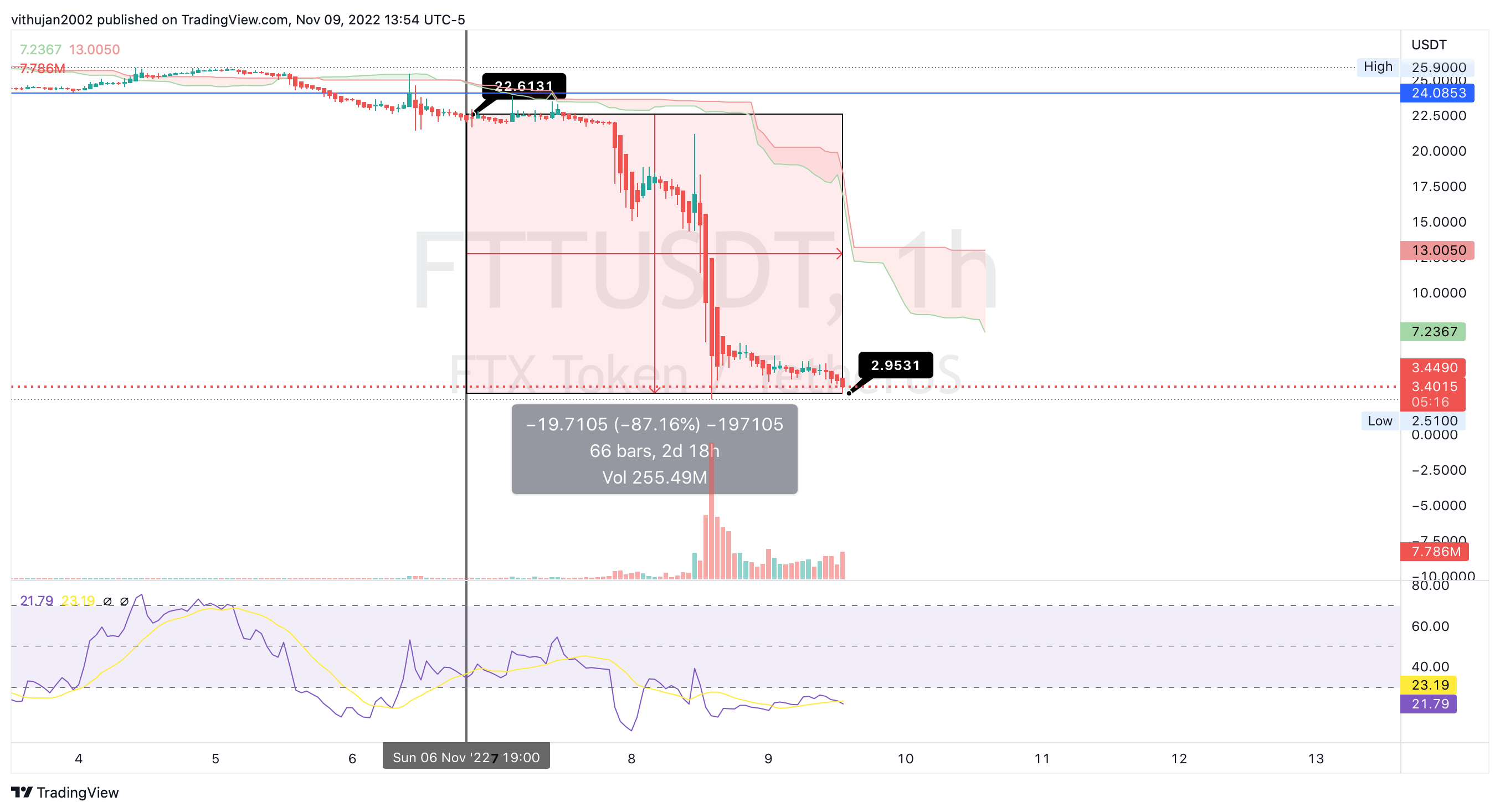

As always, he who sells first sells best. Those who immediately withdrew their funds got them back quite quickly. But as Monday bled into Tuesday, FTX’s withdrawal processing crawled to a halt. This was while FTT continued to plunge in price. The market was clearly trying to sniff out whether there was an FTT margin call trigger to punish Alameda for overextending itself.

Tuesday early morning I woke up to many messages from friends spreading rumors speculating that FTX may have been playin’ funny with da customer's money. I prayed to Lord Satoshi that FTX had not dipped their hands in the customer cookie jar.

And then, this bombshell hit the electromagnetic sphere:

This insane announcement provided probable answers to many questions.

Did FTX rehypothecate customer funds, or euphemistically use said funds “effectively”?

We don’t have a definitive answer to this question. But, Binance signed a non-binding letter of intent to purchase the entirety of FTX and pledged to attempt to make whole all customer deposits. That suggests that FTX experienced a run on its deposits and was unable to fill all the withdrawal requests of its customers. Otherwise, why would FTX need a bailout from Binance? FTX could have blown all their VC-muppet dry powder propping up Alameda, but that still wouldn’t have impaired their ability to meet withdrawals — unless they were dipping into the honeypot.

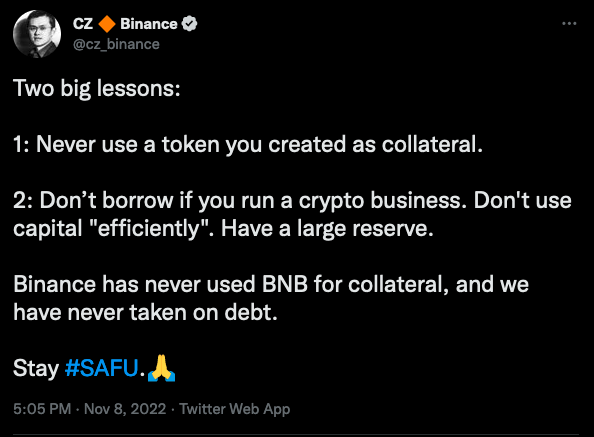

“Two big lessons.” Hmm … I wonder what situation he could be referring to? CZ clearly seems to be insinuating that FTX may have done some improper things with customer funds, and thus, when the bank run happened, they were caught with their hands in the cookie jar.

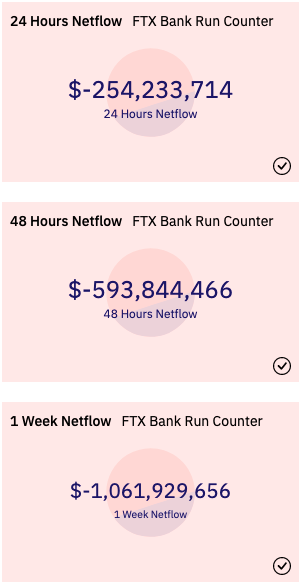

Over the last week, $1 billion of deposits fled FTX. That is what precipitated this awful turn of events. These are only the withdrawals that were processed. We do not know how many poor souls are still waiting for their money back.

Is Alameda insolvent or bankrupt?

We don’t have a definitive answer to this question. However, if FTX required a bailout from Binance, and it was needed because of financial help that FTX supposedly provided Alameda, then we can assume Alameda is probably donezo as well.

I’ll leave you with these words from Caroline Ellison, CEO of Alameda.

What happens if FTX can’t find a new home?

Similar to Mt Gox, we will probably enter yet another high-profile bankruptcy situation where depositors queue up to recover what they can. This could be a long or short process, but given how complex I imagine the holdings of FTX to be, recovery of any portion of deposits will likely take a very long time.

When looking at the broader market impact, the even bigger question is:

Which companies that run crypto loan books had exposure to FTX and or Alameda?

This is a developing story, will update it soon...

Fortune Favours The Bold.